Luxury watches have morphed into wrist-worn stock certificates, and the “Rolex Shortage of ’21” turned waiting lists into social currency. But that gravy train has left the station. The truth is, most watches aren’t investments—they’re depreciating assets faster than a new iPhone. Here’s your horological “Don’t Buy This” list, where fiscal responsibility meets wrist candy wisdom.

8. Omega

When gray market discounts make your new purchase feel like yesterday’s news.

Picture splurging on a shiny new Omega, ready to flash it around like a peacock at a finance bro convention. Then you hop online and see the same model, unworn, going for thousands less. It’s like buying concert tickets only to see them half-price on StubHub the next day.

New Omegas—Seamaster 300 and Speedmaster models especially—are easier to find than decent espresso in Italy. With unworn pieces floating around on the gray market at steep discounts, thanks to supply chains smoother than a politician’s promises, ask yourself if flexing is really worth watching your investment tank.

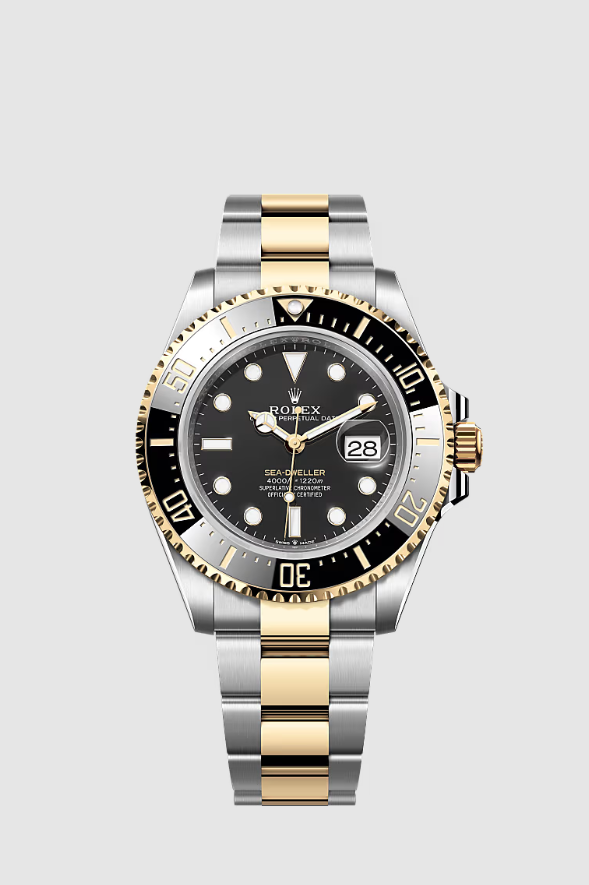

7. Precious Metal Rolex

When gold doesn’t glitter quite like steel in the resale market.

Unlike their steel counterparts, precious metal Rolex watches can be commitment-phobic financially. A two-tone GMT Master or blue-and-gold Submariner might catch your eye, but there are fewer buyers and more competition on the pre-owned market.

These “in-between” models, including the Yacht-Master, often don’t hold their value as well as steel or ultra-premium variants. The buyer base shrinks considerably, with higher price competition and narrower collector appeal resulting in greater value loss. Sometimes, the shimmer just isn’t worth the missing glimmer in your wallet.

6. Microbrands

Where warranty woes meet Reddit horror stories.

Ever tried unloading a barely-worn watch online only to get crickets and lowball offers? Microbrand owners know this pain intimately. Typically priced under £1,000, these upstarts often bleed value like a punctured tire due to low used market demand and the greater appeal of buying new for warranty coverage.

Sure, you thought you were getting a steal, but now you’re facing the grim reality of steep depreciation. Microbrands offer a cool entry point, but unless they become the next Supreme, expect your wrist candy to become a conversation starter about buyer’s remorse.

5. Tudor

The little brother that can’t quite match big brother’s hype.

Generally, expect to lose north of 25% of your money if you flip a Tudor watch shortly after buying. It’s not quite the same waiting list madness as Rolex, where your watch appreciates before you even leave the store.

Picture your credit card still smoking, suddenly realizing your shiny new Black Bay that retailed for over £4,000 is now selling for £3,000 on the gray market. It’s a harsh lesson in supply, demand, and the cold reality that not everything with a Swiss movement is a golden goose. Tudor lacks the hype and mass-market desirability of Rolex, despite sharing corporate DNA.

4. Hype Watches

When greater fool theory meets your bank account.

Before TikTok existed, tulip mania swept through the Netherlands. Fortunes rose and crashed on rare bulbs, and today, certain watches create similar frenzies. Those watches everyone suddenly has to have, where prices go vertical? Problem is, some investments rely on the “greater fool” theory—betting there’s always someone willing to pay more.

For those caught up in hype cycles, buying such watches often ends with becoming the greatest fool themselves. What goes up usually plummets, leaving collectors with expensive reminders of fleeting trends. Chasing hype is like betting on a meme stock—thrilling until the rug gets pulled.

3. Special Edition Seiko

Where “limited” meets “modest premium loss.”

Eyeing that limited edition Seiko, hoping it’ll fund your yacht someday? Most special editions are about as “limited” as a celebrity’s apologies. They generally hold their money reasonably well, but they’re as likely to make you rich as finding a perfect avocado at the grocery store.

Expect to kiss goodbye to any modest premium when it’s time to sell, but don’t expect early retirement. Seiko’s reputation centers on quality, not hypebeast mania, so these aren’t exactly investment-grade unless you’re diversifying your portfolio with shiny objects like a squirrel.

2. Breguet

When craftsmanship meets market indifference.

Owners of Breguet watches may admire the intricate craftsmanship, but depreciation can sting hard. These timepieces from one of horology’s oldest names don’t always hold their value like you’d expect, often experiencing 40-50% depreciation when purchased new unless the model is iconic or extremely rare.

Think of it as the horological equivalent of that band everyone claims to love, but nobody actually buys their albums. Reduced mainstream brand recognition and smaller pools of collectors contribute to soft demand, leaving these meticulously crafted gems behind while collectors chase current hype.

1. A. Lange & Sohne

Connoisseur’s choice, but not collector’s goldmine.

A. Lange & Söhne watches are a connoisseur’s choice, but don’t expect them to hold their value like a coveted collectible. Unlike Patek Philippe, some aging examples price at half what new counterparts cost—like buying a gently used luxury car only to watch it depreciate faster than expected.

This brand lives in a niche within a niche, which means you’re either in the club or scratching your head wondering what the fuss is about. Unless you’re planning to pass it down as a family heirloom, prepare for your A. Lange & Söhne to be more beloved trinket than blue-chip investment.

The speculative bubble has largely receded, and the pre-owned market is stabilizing as enthusiast demand replaces speculative buying. Only the most iconic, hard-to-get models consistently retain or grow their value. Purchase decisions should focus on personal enjoyment rather than short-term investment hopes—the pre-owned market offers better value for minimizing depreciation anyway.

Last modified: January 2, 2026